This post is also available in: العربية (Arabic) اردو (Urdu)

With one of the lowest ratios of tax-to-GDP in the world, Pakistanis stay behind in filing their income tax returns. The tax-to-GDP ratio of a country assesses the year-by-year development of the nation. The higher the GDP rises, the higher is the rate of revenue collection in the shape of income tax., with the demand for goods and exports have increased.

Non-filers of income tax, which is a majority of people in Pakistan, are charged more on every transaction they make, especially if they are salaried or employed. Being non-filers, as per the Income Tax Ordinance of 2001, you pay more even if you buy a needle or a private jet, because you haven’t been filing your income tax returns.

Since NADRA and the FBR have joined hands to make the process of filing your income tax returns easier, by having you do it online, it is best if every Pakistani clears their name and files their income tax returns on time. Let us teach you how to get away with the cumbersome process at the comfort of your home.

Step 1: The precautions and things you must know

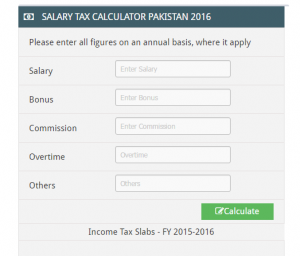

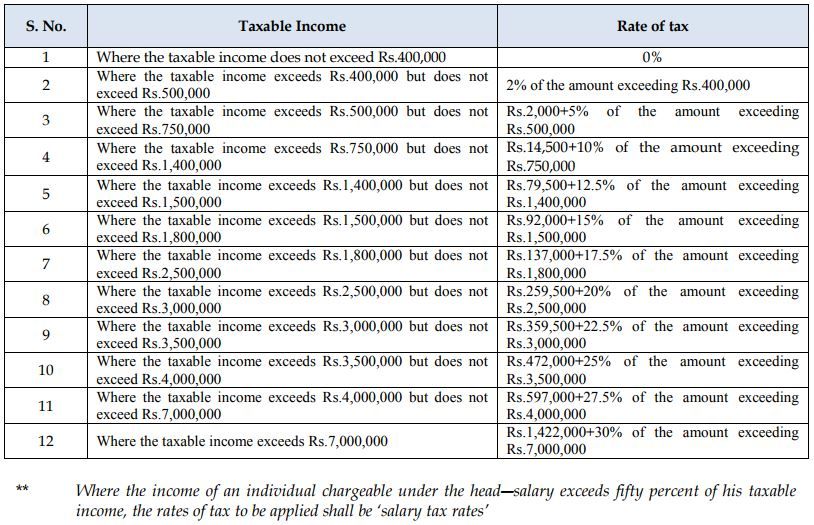

If you earn around Rs. 400,000 or more in a year, you are eligible to file your income tax returns. The income tax return is decided every year by the government in the budget allocated for a fiscal year. Before you file your tax return, you must calculate your tax rates for the given year and see which category you fall under.

Step 2: Get registered with FBR’s E-Enrolling System

Get your registration number and password from Iris through FBR’s E-Enrolling system. To reach Iris, click here — this is a convenient version for tax-payer registration and is used by development organizations all over Pakistan, especially in tenders.

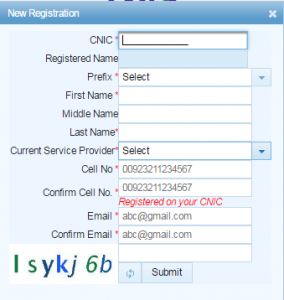

Select the registration for an un-registered person if this is the first time you are filing your tax-returns on the E-portal. Make your personal ID with all your personal details so you get your desired username and password.

Log into Iris and file in your wealth statement. For people who are salary bound, there is a special helping guide for you which you can avail by clicking here.

Step 3: Things you must note down with you

Do not forget to note your Iris registration number, which is also your user ID. For individual Pakistanis, it’s the 13-digit CNIC code without dashes. For non-Pakistanis – the 7-digit code on their NTN minus the dash and the check digit. For AOPs and Companies – the 7 digit NTN number minus the dash and check.

The most important reason to file your income tax return is to stop the government from burdening you with the WHT (withholding tax) on your banking transactions. Once you become a tax-filer, you can claim the WHT from FBR. Once an audit is done and your returns are evaluated, if you qualify, a cheque would be sent to you with your WHT.

For the well-being of the nation, every Pakistani must file their tax return. With the help of this online guide, you can skip the old cumbersome process and have everything done on the internet from the comfort of your home.